Must i score a consumer loan when you’re underemployed?

Make an application for financing

Sara Routhier, Dealing with Publisher and you will Outreach Movie director, keeps professional sense because a teacher, Search engine optimization expert, and you may blogs marketer. She’s more five years of expertise on the insurance policies world. Because the a specialist, research geek, publisher, and you will publisher she aims to curate instructional, informing articles giving your into the need-see points and greatest-left gifts into the overwhelming industry o.

Joel Ohman ’s the President from an exclusive security-supported digital mass media organization. He’s an official Monetary Planner, journalist, angel investor, and you may serial business person just who loves creating new stuff, whether guides otherwise businesses. He has and in past times served since maker and you will citizen CFP of a nationwide insurance company, Live Health Rates. The guy has a keen MBA on College or university out of Southern Florida. .

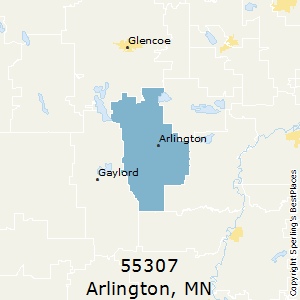

Advertiser Revelation: We strive to create confident financing decisionsparison hunting should be simple. We’re not connected to any one lender and should not make certain quotes out-of one solitary provider. All of our partnerships do not determine all of our posts. The views is actually our very own. Examine rates off different people please get into your Zip password in this post to use the newest free estimate tool. The greater prices your contrast, the greater amount of possibilities to cut.

Article Assistance: Our company is a free online capital for anybody curious about about funds. Our very own mission is to be a target, third-group money for that which you mortgage relevant. We modify all of our website frequently, as well as posts is actually reviewed from the positives.

When lenders decide if a debtor was a suitable applicant, the probability of installment is key. Loan providers scrutinize an excellent borrower’s income, and you can a job falls under you to definitely steady earnings background.

Ron Suber, lead off all over the world organization sales getting do well, a primary on the internet personal loan financing site, told you when borrowers come to their site, latest employment status and you can fico scores is fundamental circumstances of one’s application. Suber told you it assists its company determine whether the person is actually eligible for financing. In addition it impacts the interest rate and you will financing terms readily available.

Loan providers want to ensure that borrowers can pay-off its bills. Without a job, it is impractical you to definitely a borrower, just who need the bucks first off, can a pay-off the fresh financial obligation within the a punctual manner.

Monetary attorney and you may loans pro, Leslie Tayne, told you it is unrealistic having an underemployed debtor to achieve recognition to the a personal bank loan.

If you don’t have a source of income at the time of app to own paying the mortgage, it is impractical one to a creditor usually takes a danger of credit the money, she informed .

One kind of unsecured loan available to unemployed borrowers try good secured financing. Secured loans try ensured of the some kind of collateral instance just like the a work salary, a vehicle headings, or home collateral. Tayne said individuals may take-out personal loans against a good old-age or financing financing.

I would suggest against taking out finance facing yourself, especially when there is no need one income source in the the period to have filling the money, she told you.

The worth of the fresh collateral affects how big the private loan. A loan provider doesn’t mortgage a large amount of money if the brand new debtor are only able to bring an affordable piece of equity. Need initiate, collateral is used while the protection for money, and therefore a lender often repossess whether your mortgage is actually outstanding. If that safeguards is limited, so usually the amount of money a lender commonly lend.

Can i score a personal bank loan when you’re underemployed?

Unsecured personal loans was an alternative, but they normally have stricter financing laws and regulations. Personal loans angle more of a danger to loan providers, so without a job or debit card payday loans Chelmsford MA regular revenue stream, individuals cannot qualify for a personal bank loan.

Lenders are able to search prior a consistent type of work, as long as a borrower get a variety of earnings, for example personal shelter, jobless, and you may handicap. In the event the a debtor provides the means to access money from these present for every single month, certain loan providers might be ready to provide on it. Provided brand new borrower get constant money, there’s an elevated options your lender was repaid.

In the event that approved to the whichever personal loan, individuals will be compare alternatives from numerous loan providers to select the reduced interest rate available on the personal mortgage. When you’re looking for trying to get an unsecured loan, there are an online software right here.